Our World

The concept of insurance – paying a premium in exchange for risk mitigation – is 3,000 years old. Indeed, there is archeological evidence of camel caravans in Mesopotamia insuring their goods and calculating premium with piles of stones or an ancient abacus.

In 1688 marine insurance was born in a coffee shop which eventually became Lloyd’s of London.

Benjamin Franklin founded the first American fire insurance company in 1752 and The Philadelphia Contributionship is still in business today.

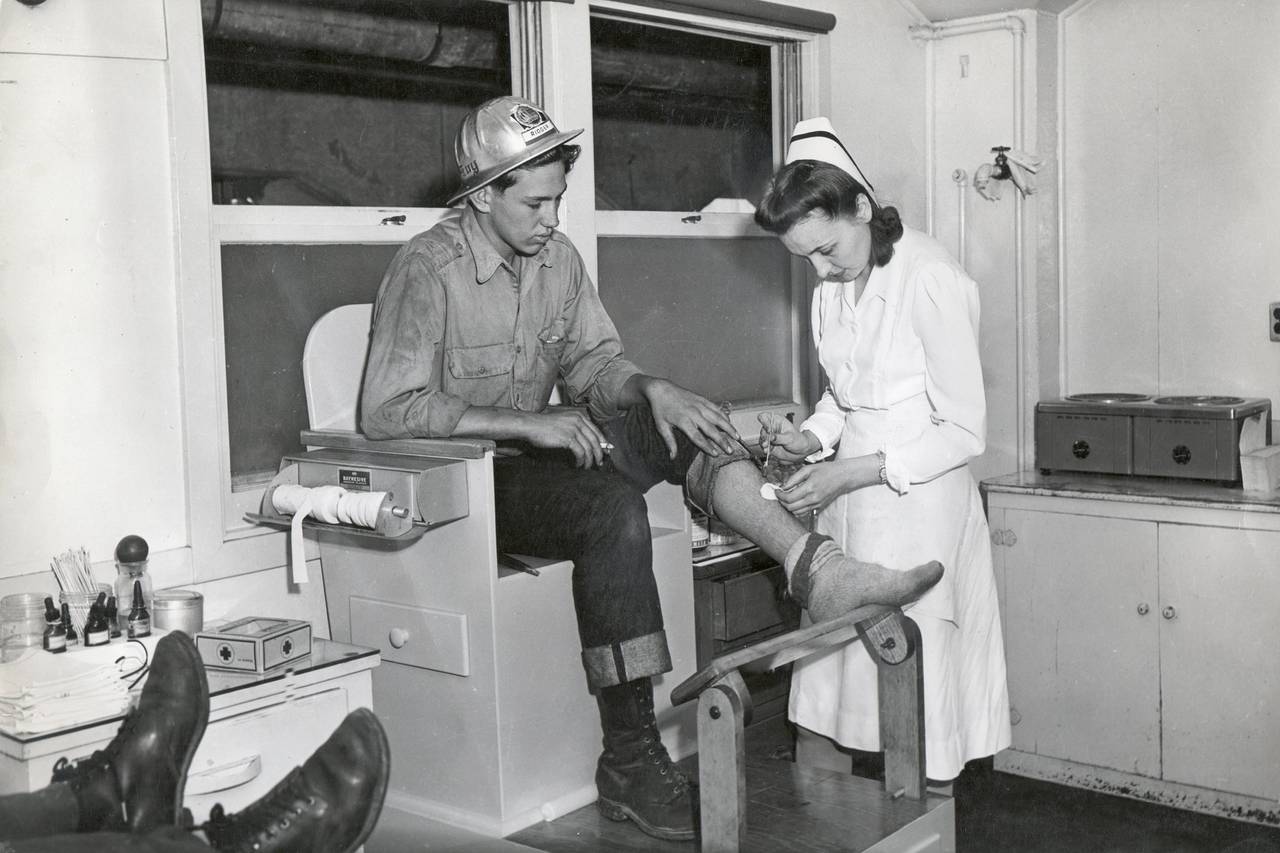

By contrast, health insurance is only 80 years old and evolved from the amazing – and increasingly expensive – advances in science and medicine during the 20th century. People live longer and feel better than ever before.

In the United States, from the start, health insurance benefits for most people were linked to their place of employment. Over time, federal and state programs also grew to provide benefits to various segments of the population. Even so, currently there are 158 million Americans who are covered by private, employer sponsored health insurance and other related benefits as part of their employment.

Risk Tolerance

We live in a rich country, enjoy a high standard of living and we tolerate less and less risk in our daily lives. Just think of the safety features of our work and play areas which were inconceivable just fifty years ago. At the same time, the vastly improved quality and availability of medical care has created a universal expectation of prompt and effective care in the event of illness or accident.

Price of Health Care

If we are sick or hurt, no price is too high to get well. No surprise then that even at times of virtually no inflation we still see health care costs trending substantially upward. There are only two mechanisms that can push back on health care prices. First, government mandated price controls such as for Medicare and Medicaid. Second, private health insurance negotiated with group purchasing power through the provider network of an insurance carrier.

Price of Health Insurance

The economic existence of insurance depends on the fact that no one can see into the future – accidents and sickness cannot be anticipated. Insurance companies rely on the “Law of Large Numbers” which allows them to forecast future claims based on past loss experience thus calculate a price for which they are willing to assume the health risk of a defined employee population. Group demographics, location, industry segment, regional cost of living factors – as well as the need to avoid adverse selection – all impact on the calculation of risk and price.

93 / 7 – Health Care vs Health Insurance

According to the U.S. Congressional Budget Office, Health Care itself (hospital, physician, Rx, etc.) consumes 93% of national health-related expenditures the other 7% is comprised of administrative overhead and insurance cost.

MSI Benefits Group

The mission of MSI Benefits Group is to help employer group clients navigate this complex world – not only as it exists now but also as it evolves with constantly changing laws, rules, regulations, products AND employee expectations.

TownPark Ravine One | 245 TownPark Drive | Suite 100 | Kennesaw, GA 30144 | 770-425-1231

©MSI Benefits Group 2021, All Rights Reserved

![]()